By: Tom Ryan

14 minute read

The automotive industry is evolving. Increases In population, road traffic, and cost of living paired with growing environmental concerns are steering more people towards alternative transportation options.

As a result, consumers and business owners alike are adjusting their priorities and — in the case of car dealerships and auto makers — adapting their business models. As society continues to evolve, there will be new opportunities for dealers who invest time into understanding the rising consumer trends related to alternative-fueled and purpose-built vehicles, or eschewing personal vehicle ownership completely.

In this article, I’ll discuss my five predictions for the future of auto retailing and what the shifts in consumer priorities mean for your business.

TABLE OF CONTENTS

(Click to jump to section)

Prediction #1 - The Mobility Ecosystem Will Evolve

Ride-Sharing and Fit-for-Purpose Vehicles

Prediction #2 - Auto Dealership Consolidation Will Continue

About Those Dealership Valuations

Prediction #3 - EV Competition and Affordability Will Increase

Prediction #4 - High Valuations of Used Cars Won’t Last Forever

Prediction #5 - The Supply Chain Will Remain Fragile

Digital Retailing & the Modern Dealership: The Road Ahead

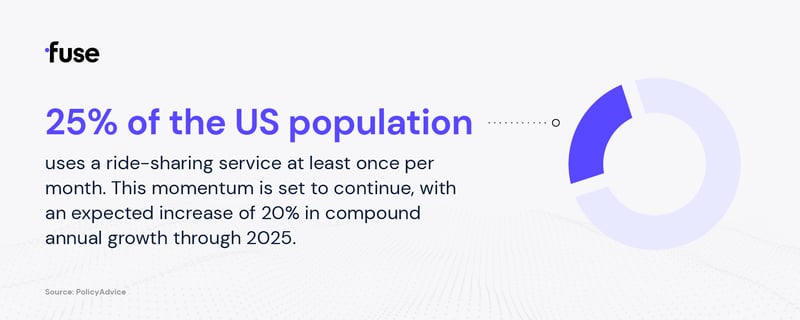

According to recent statistics, around 25% of the U.S. population uses a ride-sharing service at least once per month. This momentum is set to continue, with an expected increase of 20% in compound annual growth through 2025.

To better understand this trend, it’s important to know the players.

Those same statistics reveal that Americans between 18-29 are most likely to use ride-sharing and make up around half of the market’s customer base. Geographical location is a major determining factor in a person’s use of ride-sharing services. Adoption is higher in urban areas than rural areas for obvious reasons — as ridesharing is not as widely available or practical in rural areas.

Even among high earners, there is a marked split between urban and rural residents. Among Americans earning $75,000 or more a year, urban residents are more than twice as likely to have used these services as residents with a similar income in rural areas.

That said, ride-sharing usage is expected to increase across all age groups in the coming years. The reasons for this trend are multifaceted:

Prediction: Individual vehicle buyers aren’t going away. Although some predict that fewer consumers will enter the market for personal vehicles, there was an uptick in sales throughout the pandemic. Ride-sharing usage may impact dealerships to some degree, but the timing and severity of this consumer trend remains uncertain.

By 2030, one in ten cars sold will likely be a shared vehicle. At face value, it seems that more shared vehicles would signal an overall slump in sales.

But think about this: buyers who purchase vehicles to use for a service will need to replace those vehicles more often than private buyers. The increase in ride-sharing services doesn’t necessarily mean there will be substantially fewer car sales in the future.

In addition, car makers aren’t just sitting back and watching. They’re coming up with solutions that meet the needs of the mobility industry and help dealerships sell more cars as the market evolves.

Purpose-built vehicles are one solution. Current car prices represent a compromise of features that appeal to a broad customer base. A purpose-built vehicle could cost almost 25% less than a standard vehicle, because it generally features fewer bells and whistles. This lower upfront cost will entice more ride-share drivers and encourage more frequent replacement purchases.

According to Erin Kerrigan, founder and managing director of Kerrigan Advisors, auto retail experienced a black swan event in 2020 that’s having long-lasting effects. She said, “Dealers leveraged their new pricing power while also reducing expenses and enhancing employee productivity, resulting in record dealership profits and dramatically increased operational efficiency. All of which led to the high velocity of dealership transaction activity in 2021.”

The Blue Sky Report® by Kerrigan Advisors discusses how the auto retail industry has migrated from the local stage to a national marketplace driven by the digitization necessitated by COVID-19. This has led to the consolidation of dealerships that want to expand their business into new markets.

The digitization of auto retailing and consolidation of dealerships is changing the business model for many dealers, especially small, private ones. Kerrigan predicts that digital retailing — as well as car makers’ attempts to sell directly to consumers — will further industry consolidation into the future.

I agree with Kerrigan to an extent. Trends show an increase in larger dealerships buying out their competition. New data reveals that the 150 biggest dealership groups in the country own an ever-growing share of all U.S. dealerships. However, according to Automotive News, these top dealerships owned just 21.1% of all U.S. dealerships as of 2020.

To break it down further, out of 18,263 dealerships, only 3,849 are owned by the top-ranked dealerships nationwide. Prediction: Dealership consolidation will continue, but it will not impact the majority of the market.

With large dealer groups going on buying sprees, it’s easy to assume they have a positive view of the market. Indeed, they do. According to the Kerrigan Dealer Survey, dealers are optimistic about the valuation of their dealerships over the next 12 months.

The survey also found that 33% of 680 dealer respondents expect the value of their dealerships to increase, up from 26% one year ago.

Caution: These values won't last forever. Dealerships may have another banner sales year due to lower supply and continued demand, but inflation has a tendency to shake consumer confidence.

Competition is increasing in the electric vehicle (EV) market as legacy auto manufacturers and newcomers offer more affordable options.

Electric vehicles have gotten a lot of attention lately, especially with high gas prices, new emissions standards, and the crisis in Ukraine.

Prediction: The U.S. isn’t going to switch to an electric model overnight. Access to the minerals used to make EV batteries is volatile right now: the lithium, cobalt and nickel supply chain is dominated by China. The U.S. also needs a grid system that can support the charging of EVs, a reliable network of charging stations, affordable EV options, and a ready supply of inventory.

Even BMW’s CEO Oliver Zipse warned that phasing out internal combustion engine technologies too soon, when there is still a huge demand for gasoline-powered vehicles, would be unwise.

Following is what needs to happen for electric vehicle demand to grow.

According to the U.S. Energy Information Administration, by 2050 only 30 percent of cars on the road will be fully electric under current policies. Environmental advocates would like to see this number greatly increase.

The trend toward electric vehicles is primarily driven by people ages 18-34 (40%). Those least likely to purchase EVs fall in the 50-64 and over 65 groups. Of these would-be car buyers, most are likely to be male (68%). These statistics indicate that policy makers, auto makers, and marketers have some work to do to appeal to other demographics for increased electric vehicle adoption.

Over the years, there have been some false starts with electric cars that have permeated negative views about their use. Valid concerns over range, reliability, and cost persist. EVs cost $15k-$30k more than their gasoline-powered counterparts — a point that must be addressed for adoption to accelerate.

Currently, the U.S. ranks second in the world for publicly available electric vehicle chargers. As of 2020, there were 82,263 slow chargers and around 16,700 fast chargers nationwide. Globally, China ranks first, with more than 800,000 chargers.

While these numbers are promising, the U.S. must build up its charging network and offer faster options to meet the needs of everyday drivers. With infrastructure and range concerns addressed, adoption will organically improve. Offering more affordable options will also increase demand for EVs, especially if gas prices don’t come down.

For some consumers to consider buying an EV, they want one that performs similarly to their gas-powered vehicle or features the creature comforts they’re used to in a luxury car. Manufacturers like Tesla have risen to this challenge.

Other manufacturers are also getting in the high-end game. Ford, for example, recently introduced the 2022 Ford F-150 Lightning electric truck. As more car makers offer a variety of options at low and high price points, more consumers will be willing to switch to electric.

There are many factors contributing to the speed at which EVs become mainstream — some for and some against. One strong positive factor is federal subsidies for car manufacturers to invest in electric vehicle design and production. In 2021, governments approved about $2 billion in incentives.

Michigan passed a $1.5 billion bill that expanded existing state incentives to include EV production. As a result of this new legislation, GM committed to investing nearly $7 billion to convert a factory for building EVs and building another for making batteries. This is all good news for EV fans; however, excitement must be tempered as legislation can change as administrations change.

Inflation is affecting us all, from rising grocery prices to rising interest rates. Paired with lower supply and more demand, car buyers are paying a lot more for used vehicles than they were one year ago.

While the used car market saw a boom in the past few years, I predict this will level out because we’ve sold and leased fewer new cars due to the chip shortage, disruption in Ukraine, and because new car sales were down the last two years. Prediction: We’ll still see inventory shortages for a while, but over time, there won’t be as many used car trade-ins put back into the market for people to buy.

With events like COVID-19 and the conflict in Ukraine, supply chains are still facing serious disruption. Unfortunately, it's going to be bad for a while.

However, need is one of the biggest — if not the biggest — driver of innovation. Prediction: Expect exciting things from more auto manufacturers.

Speaking of innovation — some auto manufacturers are coming up with creative ways to overcome supply chain shortages.

In a 2021 shareholder letter, Tesla wrote, “In Q1, we were able to navigate through global chip supply shortage issues in part by pivoting extremely quickly to new microcontrollers, while simultaneously developing firmware for new chips made by new suppliers.”

Ford and GM are also stepping up to solve the chip shortage. According to the Wall Street Journal, Ford formed an agreement with GlobalFoundries, a U.S.-based semiconductor company, to develop computer chips. Ford may also bring chip development in-house. General Motors Co. President Mark Reuss revealed that the company will co-develop semiconductors with several producers to make chips that can handle more electronic features in its vehicles. One caveat: it takes two to three years at a minimum to spin up a chip plant.

In the background of everything else that’s happening, violence is raging in Ukraine. According to the S&P, the conflict is expected to lower global light-duty vehicle production through next year by millions of units. The conflict continues to impact supply chains and shortages of key vehicle parts. There’s no way to know the outcome, which puts pressure on the auto industry to be resourceful and find new ways to meet the demands of consumers and shareholders.

China’s saber-rattling against Taiwan, a major producer of computer chips, could cause another — potentially much larger — disruption to the automotive supply chain. While military action by China against Taiwan is currently no more than a threat, a future conflict between these two countries could have a catastrophic impact on a multitude of industries — including automotive.

Despite these challenges, many changes affecting the automotive industry provide promising opportunities for dealers:

Modern auto dealers are embracing these trends by moving towards more automated and digital ways of closing a deal. However, this requires dealerships to rethink their organizational structures, as well as invest in new technology and dealer consulting services-led training.

Dealers implementing a single point-of-contact customer experience are seeing great success. For example, the Walser Automotive Group moved to a negotiation-free sales model in 2001, and single-point-of-contact model in 2012. Over the last two years, Walser added nearly 5% of market share, with 23 of 27 stores across three states realizing increases. They’ve not only seen improved customer response, but also significant improvements in the quality and quantity of employment candidates.

My prediction is that automotive digital retailing solutions are only going to grow. Competitive dealerships must invest in the tools needed to meet the demand.

As we continue to feel the weight of COVID-19’s impact on the automotive industry, we also see many trends being tested with consumers.

We may have to wait for a few more earnings cycles to see which strategies should be kept and which ones should be let go based upon the numbers.

Put simply, we’re entering a time of accelerated change. Despite what some foresee to be obstacles in our way, I foresee automotive retailers employing smart maneuvering to steer their dealerships to success.

The ultimate question is — is your dealership prepared for the road ahead?

Get in touch with Fuse now to find out how we can help your dealership embrace the future of automotive retail.

Today’s electric and hybrid cars appear nearly unrecognizable when compared to the first gas-powered car models created in the 1880s. The same cannot be said for the actual process of buying a...

News and Insights

10 min read

Solutions